Below is our assessment of legal developments in the Turkish automotive sector. Our assessment includes:

- Consideration of new regulations in the Turkish automotive sector, introduced in response to European Union harmonization studies, government promotion issues, and consumer protection issues.

- Consideration of amendments and new regulations regarding the type of approvals for vehicle parts, issued by the Ministry of Science, Industry and Technology, as well as a Sector Report published by TAYSAD (Association of Automotive Parts and Components Manufacturers).

- Brief information about Car-Sharing, a new format of transportation system in Turkey.

Turkish Automotive Sector as of June 2013 and the Plan for the Near Future

A) Manufacturing figures

According to a report published by TAYSAD, 584.621 vehicles were manufactured in Turkey between January and June 2013, a reduction of 0,3 percent compared to the same period in 2012. Of these vehicles, 303.783 are cars, 265.562 are commercial vehicles and 20.276 are tractors.

B) Export figures

For the period January to June 2013, 428.211 vehicles were exported from Turkey, an increase of 5 percent compared to the same period in 2012. Oyak Renault led the sector in this regard, exporting 142.979 vehicles between January and June 2013. Oyak Renault significantly increased its number of exported vehicles by 23 percent compared to the same period in 2012. According to the TAYSAD report, Toyota, Honda, Man, Temsa and Hattat Tarım have considerably reduced export activity in 2013.

The total industry export amount reached $1,802,439,148, equal to an increase of 12 percent compared to the previous year.

C) Internal market figures

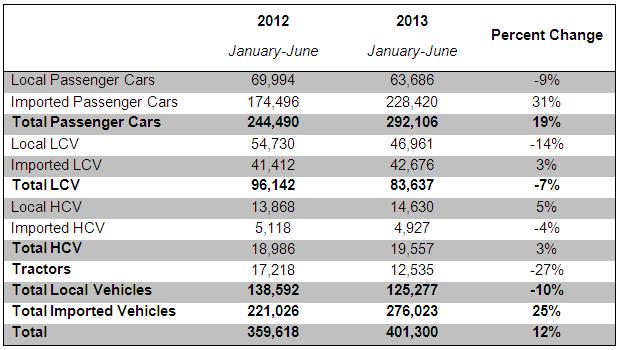

In Turkey, 292,106 vehicles were sold during the period January to June 2013, an increase of 19 percent compared with the same period in 2012. The first half of the year involved a 31 percent increase in imported vehicles compared to the same period in 2012.

While the sale of light commercial vehicles decreased, the sale of heavy commercial vehicles accounted for the internal market’s overall sales increase.

Please note that for the January to June 2013 period, the total Turkish internal market has decreased by approximately 10 percent, compared to this same period in 2010.

The table below shows the figures and related rates for January to June 2012 and 2013.

D) The Ministry of Industry of Science, Industry and Technology’s Legislation Activity Plan with Respect to the Automotive Sector

In 2011, the Ministry of Industry and Commerce published a Strategy Certificate and Activity Plan for 2011-2014. Within the scope of improving legal and administrative regulations, the plan includes the following steps:

- Revise the related tax system in order to encourage use of eco-friendly vehicles,

- Create legal regulations in order to junk older vehicles and encourage junk companies,

- Synchronize Turkish legislation with the EU and United Nations approval regulations,

- Carry out market surveillance and inspection studies.

Some of these steps may only be carried out after various studies are conducted. Therefore, future automotive sector updates are expected to include discussion of the activity plan outlined above.

Recent Product Safety Regulations in Relation to United Nations Regulations and European Union Harmonization Studies

Since 1999, Turkish legislation has adapted various regulations in response to European Union approval directives and United Nations obligatory technical requirements.

These regulations include the examination standards of motor vehicles used by the Turkish Standards Institute, to be approved by the Ministry Science, Industry and Technology.

The table below outlines recent regulations notified in the Official Gazette during 2013 and legislation which will be effective within this coming year.

Issues in Consumer Law Regarding the Automotive Sector

Outlined below are significant recent decisions by the Court of Appeals related to consumer law in the automotive sector. These decisions also consider regulations introduced under the new Code regarding Protection of Consumers numbered 6502 published on the Official Gazette dated November 28 and numbered 28835 (“New Consumer Code”). This Code will repeal the Code regarding Protection of Consumers numbered 4077 and will enter into force six months after the publication date.

A) The Court of Appeal affirmed a consumer’s right of choice under Article 4/2 of the Turkish Code on Consumer Protection in circumstances where the consumer claims a refund on the basis of a hidden defect related to a car’s coloring. However, in the event that the decision unduly affects the balance of rights or benefits between the parties, the district court should evaluate the alternative remedies of price reduction repair free of charge. (2013/8695 E. and 2013/10214 K., dated 4.18.2013).

Article 11 of the New Consumer Code does not amend the general principles regarding a consumer’s right to choose a remedy. As in the old code, if a defective product exists, the consumer is entitled to choose one of the following remedies: repair free of charge, replacement of the product, termination of the agreement, and price reduction. The decision described above is significant because it introduces a new principle for the seller’s benefit.

Parallel to this decision, the New Consumer Code includes a new provision which states:

“In the event that exercising the consumer’s right to request repair of the product free of charge or replacement of the product would impose disproportionate difficulties on the seller, the consumer may use one of the rights of termination of the agreement or price reduction. Factors relevant to determining whether exercising the consumer’s right causes disproportionate difficulties in a given set of circumstances are the value of the (non-defective) product, the importance of the defect, and whether exercising the consumer’s right to choose would constitute any trouble for the consumer” (Article 11/3).

Therefore, gradually the consumer’s right to choose a remedy with regard to a defective product has begun to be tempered for the seller’s benefit.

B) The Court of Appeals decided that if the consumer still possesses the car in question, the consumer (plaintiff) cannot request interest on a refund claim which is based upon a hidden defect in the car’s coloring. (2013/3426 E. and 2013/7058 K., dated 20.03.2013). The New Consumer Code does not affect application of this decision.

C) The Court of Appeals decided that if a consumer obtains credit to purchase a product and then later claims a refund on the basis of a defect in the authorized technical service, the interest which the consumer has paid to the bank cannot be charged to the defendant. This is because there is no unjust enrichment in relation to the technical service because the defendant has received no income from the consumer’s use of credit in these circumstances. (2012/5689 E. and 2012/9013 and dated 03.04.2012).

Article 30 of the New Consumer Code addresses tied loans, where credit is given to the Consumer by a party other than the car’s seller specifically for purchasing that product – both the loan and sales agreements are deemed to be an economic unity. Where the consumer obtains credit as part of a tied loan and then later the consumer seeks to terminate the sales agreement or receive a price reduction on the basis that the product was not delivered (or not properly delivered), the seller and the creditor shall be severally responsible. If the consumer exercises his/her right to receive a price reduction, the tied load shall also be reduced at the same rate. If the consumer exercises his/her right to terminate the agreement, the seller, provider and the creditor shall be severally responsible to reimburse the consumer for the payments he or she made up to the termination date. The creditor’s responsibility is limited to one year from the date of delivery (or one year from the date of the sales agreement where the product is not delivered). The creditor’s liability is also limited to the amount of the credit granted.

D) The Court of Appeals decided that if a consumer requests replacement of a defective product based on repetitive breakdowns (more than two) and the consumer continues to use the defective product even after opening a law suit, this use does not affect the manufacturer’s liability under Article 4 of the Turkish Code on Consumer Protection (Code numbered 4077). (2009/4-246 and 2009/297 dated 01.07.2009). Article 4 in the old Code is the equivalent of the Article 8 of the New Consumer Code and Article 14 of the Warranty Regulation.

Recent Investment Incentive Amendments Applicable to the Automotive Sector

The Decree on State Support to Investments (“Decree”) outlines various matters related to investment incentives available in relation to the Turkish automotive sector. Article 2 of the Decree states there are three types of the incentives: General Investment Incentives, Incentives for Large Scale or Regional Investment, and Sector Based Incentives.

The Amending Decree on State Support to the Investments (“Amending Decree”) affects investments made from June 19, 2012. If investments meet certain criteria, the Amending Decree states they are deemed to be priority investments and may be eligible to receive reductions in tax rates, insurance premiums and interest rates for bank credit, among other benefits. According to Article 4 of the Amending Decree, the following investments are deemed to be priority investments within the scope of Article 17 of the Decree:

- Investments in the motor road vehicles industry valued at TRY 300 million or more,

- Motor investments valued at TRY 75 million or more,

- Investments related to motor parts, drive line parts and automotive electronics valued at TRY 20 million or more

Investments made in Region V are eligible for the associated incentives, irrespective of whether the investment meets the thresholds stated above (please see the table below for information about which cities are included in Region V). However, investments located in Region VI will not benefit from the incentives. For these investments, the specific incentives determined for Region VI will continue to apply.

Car Sharing: A New Form of Transport

Recently, the Turkish automotive sector and consumers have discovered car sharing as an alternative to car rental. Car sharing has been common in other countries for approximately 25 years. Car sharing allows consumers and companies to rent a range of cars, from specific places, for any period desired by the consumer.

Consumers who wish to benefit from the system become members of the car-sharing company’s system via the relevant website. These systems provide the consumer with a username and password, as well as a member card. This card allows consumers to make reservations for any car and rental period, collected from pre-determined places.

Car sharing sector leaders in Turkey are Mobicar and Yoyo. These systems are attractive to customers, companies, or other groups because they allow easy use of a variety of comfortable cars on a day-to-day basis. This eliminates the disadvantages of urban transport and reduces car ownership rates, without eliminating the inherent comfort of private transportation.